There Goes the Cavalry

One of the state’s so-called money-saving budget moves is robbing Texans of their eyesight — all because a highly trained physician can no longer afford to see them.

One of the state’s so-called money-saving budget moves is robbing Texans of their eyesight — all because a highly trained physician can no longer afford to see them.

Diabetes, uncontrolled, ravages its victims’ bodies. It destroys their kidneys. It ruins their nerves and blood vessels. And it blinds them. A deadly combination of genetics, diet, and economics have made South Texas the epicenter of a diabetes epidemic.

Like a magnet, all of that drew a young Harvard-educated ophthalmologist to the lower Rio Grande Valley. Fresh out of fellowship at an institution that helped develop a drug that “was going to be a total game changer for diabetics,” Victor H. Gonzalez, MD, turned down an offer to practice in Beverly Hills — and moved to McAllen.

“It struck me,” Dr. Gonzalez recalled some 25 years later. “Here I have the opportunity to go somewhere, to bring Harvard to the Valley, in a sense, because the people from the Valley can’t go to Harvard — they can’t even go to Houston — and bring that type of intervention down here.”

Dr. Gonzalez founded Valley Retina Institute (now part of Gulf Coast Eye Institute) in 1994. He not only treated patients for their diabetic retinopathy — the complication of diabetes that can lead to blindness — he also won funding for clinical trials on the promising new medicines he had studied at Harvard.

“We were receiving down here what eventually became the standard of care for the world, almost 15 years before the rest of the world got it,” he said. “We had access to it because we had the research program, the protocols that gave us the opportunity to offer that to our population.”

Still, Dr. Gonzalez found that running his practice was a financial juggling act. Given the Valley’s poverty, very few of his patients were covered by private insurance. About 60 percent were both poor and elderly, covered by both Medicare and Medicaid; another 15 percent just by Medicaid, which pays about two-thirds of Medicare’s rates; most of the rest are uninsured, “which we do a lot of free work for.”

He made it work until 2012 because of the complex financing involving the bulk of his practice, the 60 percent covered by both Medicare and Medicaid – the “dual-eligibles.” Between the state and federal governments, caring for those patients earned Dr. Gonzalez a fee equal to Medicare’s standard payment for office visits and procedures.

Then the state slashed its share, drastically. “All of a sudden the floor gets pulled out from under us, and for over 60 percent of the practice we get a 20-percent revenue cut,” Dr. Gonzalez explained.

The juggling act got a whole lot more complex. As the practice sought out a more balanced mix of payers, it had to “significantly cut back” on free care. Then, in an attempt to further reduce costs, the state specifically targeted ophthalmology services and reduced what Medicaid pays for eye care. “It’s just been a constant assault on us,” he said.

Three of the institute’s seven physicians left for greener pastures, and Dr. Gonzalez hasn’t been able to recruit replacements. “Why would you want to come to a place when you … can move somewhere else and get a 27-percent increase in revenue to see the same number of patients?”

All of that means the uninsured and dual-eligible diabetic patients — the ones that attracted Dr. Gonzalez to South Texas — have to wait longer for care.

“By the time we see them, the disease is much more advanced than it would have been if we would have had access to them earlier,” he said. “The only new people I see now among Medicaid and the dual-eligible patients are emergencies, because that’s all the room that I have. Any type of preventive work that’s elective, I can’t see them.”

Emergency care, of course, is more expensive for the state. And Dr. Gonzalez says he can stabilize the disease process and recover lost eyesight for about 80 percent of the patients who can’t get in to see him until they have an emergency. But, he adds, that is far below the promise of available treatments when they are instituted on time.

“There’s a good 20 to 25 percent of them that I stabilize, but they’ve lost a lot of vision unnecessarily,” he said. “Unless we can change this, we’re going to revert back to where we were 20 years ago when I first showed up here, with a lot of people with very advanced disease, going blind.”

In Texas, physicians’ practices are small businesses, but big business. They create more than 670,000 jobs and generate almost $118 billion in economic activity. [See Special Report: Texas Physicians Inject Billions into Lone Star State Economy.] Like any other business, physicians can provide life-saving care only when practice revenues exceed expenses. Low payments from public and commercial insurance plans, artificial restrictions on physicians’ business activities, and increasing costs to comply with stifling government regulations and insurance company red tape combine to threaten the viability of many players in this critical sector of the Texas economy. TMA’s recommendations for legislative action include fair payments for physician services, elimination of unnecessary regulations, and prohibition of outside entities’ incessant interference in how physicians care for our patients.

Protect Practice Income

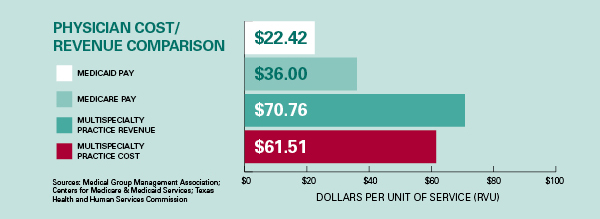

Much of physicians’ payments are controlled by government price-fixing, and physicians have little leverage in negotiating contracts with commercial insurers. Neither Medicare nor Medicaid payment rates have come anywhere near keeping up with the cost of running a practice. Physicians need appropriate pay for the life-saving, health-preserving services they provide, and relief from archaic laws that inhibit them from providing services their patients need.

TMA recommends that the Texas Legislature:

- Provide payments to physicians that at least meet the cost of caring for patients in the Medicaid program.

- Repeal payment cuts for services provided to vulnerable patients covered by both Medicaid and Medicare.

- Allow patients to obtain commonly prescribed medications from their physicians, on the spot.

Limit Practice Expenses

For most physicians, extra expenses come in the form of the lost time and added staff needed to respond to the multitude of unnecessary intrusions from government health programs and commercial insurance companies. [See Section 1: Stop the Interference.] Like other small businesses, however, one age-old item looms large in the debit column: taxes. Recognizing the unique nature of health care when they rewrote the state’s business tax in 2006, legislators included exemptions for the free and under-paid care physicians provide to Medicaid, Medicare, the Children’s Health Insurance Program (CHIP), workers’ compensation, military, and charity care patients. Because physicians have contractual and ethical obligations to care for patients, often without regard to their own financial interests, their losses on unpaid and underpaid services are unavoidable and substantial.

TMA recommends that the Texas Legislature:

- Ensure that any tax legislation that affects health care does not harm patient care or access by reducing or eliminating exemptions for charity and under-paid care.