For a sizable chunk of her 21 years in practice, Longview internist Brenda Vozza, MD, used an outside company to do her billing.

That company charged her 12% of the claims it billed and collected on her behalf, “and that was sometimes running $15,000 a month, which is quite a bit for me and my … two midlevel providers,” Dr. Vozza said.

Medical billing services aren’t a negligible expense to begin with, especially for a one-physician shop like hers. So when Dr. Vozza heard about the state comptroller’s intention – first announced in November 2019 – to impose a tax on those services, she was glad she’d decided a year ago to bring her billing in-house.

Medical billing companies would undoubtedly pass on the 6.25% tax on their services to their physician clients, who then can pass the added cost on to … no one. That’s because physicians generally would not be able to change the prices they charge patients to make up for the tax because their contracted rates with insurers are set in stone.

“I know it would be devastating for a lot of small practices,” Dr. Vozza said. “When I saw that coming up, I was thrilled that I had moved out of a medical billing company.”

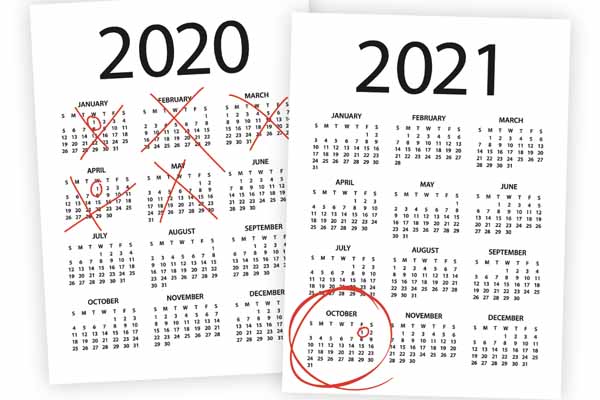

For now, practices that already have billing expenses cutting into their revenue stream can exhale too. In the spring, just days before the April 1 effective date of the tax, Comptroller Glenn Hegar announced he would delay it until Oct. 1, 2021.

That gives the Texas Medical Association – which lobbied successfully for one delay on the tax – time to work with the comptroller, as well as help craft a solution when the Texas Legislature convenes early next year.

One delay, then another

It’s been nearly two decades since Texas levied a tax on medical billing. Until 2002, the state considered medical billing services to be taxable services falling under insurance claims adjusting or processing.

In announcing a revised interpretation of the tax code – originally planned for an effective date of Jan. 1, 2020 – the comptroller’s office noted there aren’t any specific laws or rules addressing whether medical billing is taxable.

“In 2002, the agency determined that merely completing a form for the insured did not rise to the level of claim processing,” the comptroller’s office said in its November 2019 announcement that it was taking a different tack. “The agency also determined that claim processing does not begin until receipt of a claim by an insurance company. Thus, medical billing services which happened before the claim was submitted were not taxable.”

But, the comptroller’s office went on to explain it had decided that timing – e.g., before or after the claim – doesn’t matter. Its announcement said that in “non-medical scenarios,” services involving an insurance claim are taxable; other than medical billing, the comptroller has never made a distinction between services performed before or after the insurer receives the claim.

The statement also noted the tax code’s definition of insurance claims adjustment or claims processing: “any activities to supervise, handle, investigate, pay, settle, or adjust claims or losses.”

“The preparation of an insurance claim must occur prior to the claim being submitted to the insurance company,” the comptroller’s office said. “Preparation of a claim is an inherent part of the insurance claim process. Medical billing services to prepare a medical insurance claim for filing constitute insurance claims adjustment or claims processing. Thus, medical billing services are insurance services.”

Just like the state sales tax on most goods, the current tax on insurance services is 6.25% – and local taxes can potentially tack another 2% on top of that.

Concerned about both the new tax interpretation and what would happen if it were implemented too quickly, TMA led a coalition of more than 40 organizations and companies that successfully persuaded the comptroller’s office to at least delay its effective date by three months, to April 1.

Then, in late March, the agency announced the second delay until October 2021, “allowing industry time to seek a legislative change.” For now, Comptroller Hegar said in a statement, “the policy remains that medical billing services that occurred before a claim was submitted are not taxable insurance services.”

Then TMA President David C. Fleeger, MD, thanked Comptroller Hegar for the move, noting it came during a “time of immense stress” on Texas physician practices during the onslaught of COVID-19.

“He and his staff had an open door and listened to our concerns over this new tax and lifted this new burden,” Dr. Fleeger said.

John Flores, MD, chair of TMA’s Council on Socioeconomics, also applauded the timing of the comptroller’s decision.

“I see it as reassuring that the comptroller has stepped back and … given the legislators a chance to reexamine this. It’s going to hopefully sustain the protection of the access to health insurance, and more importantly, of physician-led health care,” said Dr. Flores, whose internal medicine practice uses an outside billing company. “At these times, when we’re going to have COVID-19 and the coronavirus, I think that’s doubly important.”

Taking control

Frisco internist Bryan Johnson, MD, a past member of TMA’s Council on Legislation, is optimistic about reaching a legislative solution during 2021 and avoiding the medical billing tax altogether. He is blunt about the impact the medical-billing industry already has on private practices: “If you want to go out of business as an independent physician, outsource your billing.”

When his two-physician practice started two decades ago, Dr. Johnson recalls he hired an outside billing company for the first six months to a year. Back then, the tax was in effect. Then he brought billing under his own roof.

“The problem is that the billing companies will often go for the low-hanging fruit. The claims that the medical billing services submit are the claims that do not require a lot of work in getting reimbursed,” Dr. Johnson said. “It is when your claim gets denied that the process of getting reimbursed requires a system that is tenacious and precise. Medical billing companies will often write off these claims.

“An outside billing company doesn’t fight for you. They don’t go after the harder cases. … But if you want to excel at what you do and get paid for what you do, you have to go for the hard money. And that can make up, depending on the practice, could make up 15% or 25% of your revenues. So you’ve got to go for that, and you’re just not going to get it from outsourcing it.”

If the billing tax comes into play, small billing companies themselves will face the same problem small practices do. Carole Storm, who runs Storm Medical Billing in Austin, told Texas Medicine that she’d have to pass on “probably almost all” of the 6.25% levy, because her company is so small she can’t absorb the cost, either.

“I work with mainly mental health solo providers who are small, and they’re not paid very much for their … sessions anyway by insurance companies,” she said. “So that additional cost would be huge.”

Dr. Vozza, the Longview internist, is mindful of how entrenched outside billing is for many practices: “Not every practice thinks that they can do their own billing,” she said. “They probably can, but some people are so used to letting someone else do it, it’s not an option for them.”

However, Dr. Johnson believes even if the medical billing tax does become a reality, physicians need to realize – and use – the leverage they have with billing companies. The physician is the one “feeding these companies,” he says. In light of the increased costs of the would-be tax, doctors could renegotiate the percentage they pay the billing company or hire someone in-house at an hourly rate.

“Physicians are always in the driver’s seat,” he said. “Whether this comes or goes, physicians don’t have to run scared and believe that their only option is to outsource their billing. Because if it comes, then you walk away from that [relationship]. You still want to make money, because it’s what you do, but you always have options when it comes to billing.”

Tex Med. 2020;116(6):30-32

June 2020 Texas Medicine Contents

Texas Medicine Main Page